Mr. Tan, a 66-year-old retiree from Bishan, was concerned about rising living costs and shrinking savings. Like many others, he wanted better control over his monthly expenses — without relying on outside help.

After registering, he started using simple AI-based budgeting tools. No technical skills required.

“These tools helped me track my spending clearly. I now understand where my CPF savings and daily

expenses go, and I even manage to set aside a small buffer each month.”

— Mr. Tan, 66

Mr. Tan now uses basic automation and planning tools to feel more confident about his financial future.

💼 What You'll Get After Registering

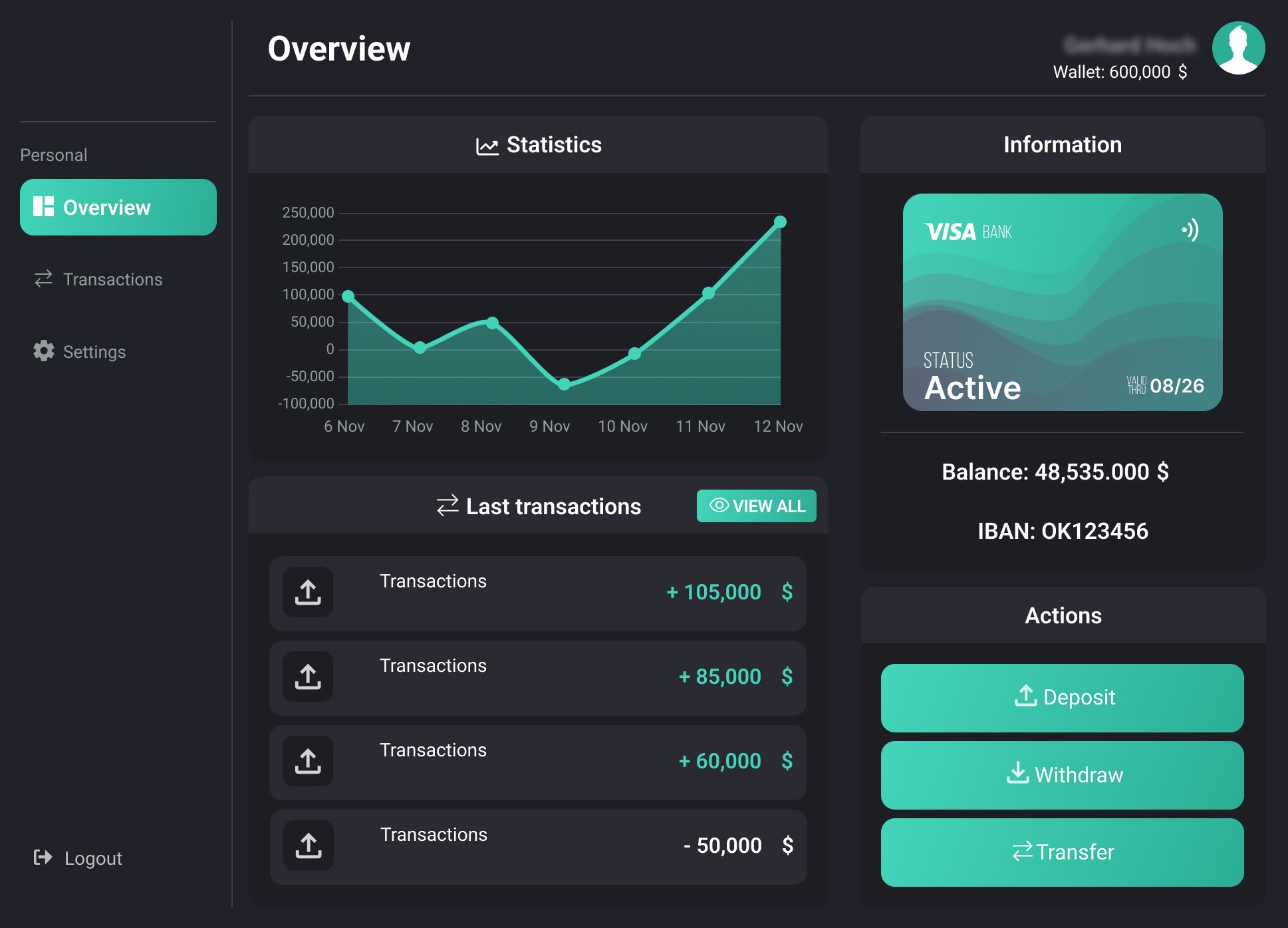

- A list of beginner-friendly AI tools for budgeting and planning

- Simple, guided tutorials — no tech background needed

- A downloadable retirement-friendly budgeting template

- Strategies to reduce unnecessary spending and increase visibility over your finances

- Email support and learning tips (optional)

⚙️ How It Works

- Register on the website

It’s free and takes under a minute. - Get instant access to financial tools and guides

Everything is explained in plain language. - Apply what you learn at your own pace

No pressure. Start with small improvements.

👥 Who It’s For

- Singaporeans approaching retirement

- Retirees looking to optimise their income

- Anyone who wants smarter control over their money

📩 Register Now

Join hundreds of Singaporeans already improving their financial habits with technology.

After registering, you’ll receive:

- A free financial planning guide

- Step-by-step tool recommendations

- Ongoing tips for better money management